What makes one investor stick with their strategy through market swings while another panics and pulls out? Often, it comes down to mindset. Your investing mindset can shape how...

No succession plan yet? You’re not alone. Learn the top questions to ask now to secure your business’s future and avoid costly missteps.

How much should you save for retirement? Use these age-based milestones and expert tips to build a secure financial future.

Markets have been on a roller coaster, and investors are asking: Is a bear market on the way?

Looking to minimize your tax bill for years to come? Discover key strategies for high-net-worth individuals, from tax-advantaged accounts to charitable giving and real estate investments.

As spring heats up, the U.S. economy cools. Growth slows, inflation eases, and stocks adjust. Is this the calm before the next big market move? Find out what 2025 has in store for investors.

It’s been hard to miss the wave of attention-grabbing headlines lately. News cycles have been dominated by concerns over Big Tech’s earnings, trade tensions, and a potential economic slowdown in 2025. Even seasoned investors can feel uneasy when faced with headlines like these.

Will you have enough to live comfortably in retirement? How confident do you feel about your retirement plans? It’s natural to wonder whether you’re truly prepared for the future.

After reaching new record highs in recent weeks, markets plunged on worries that cheaper AI competition from China could pose risks to U.S. tech companies.

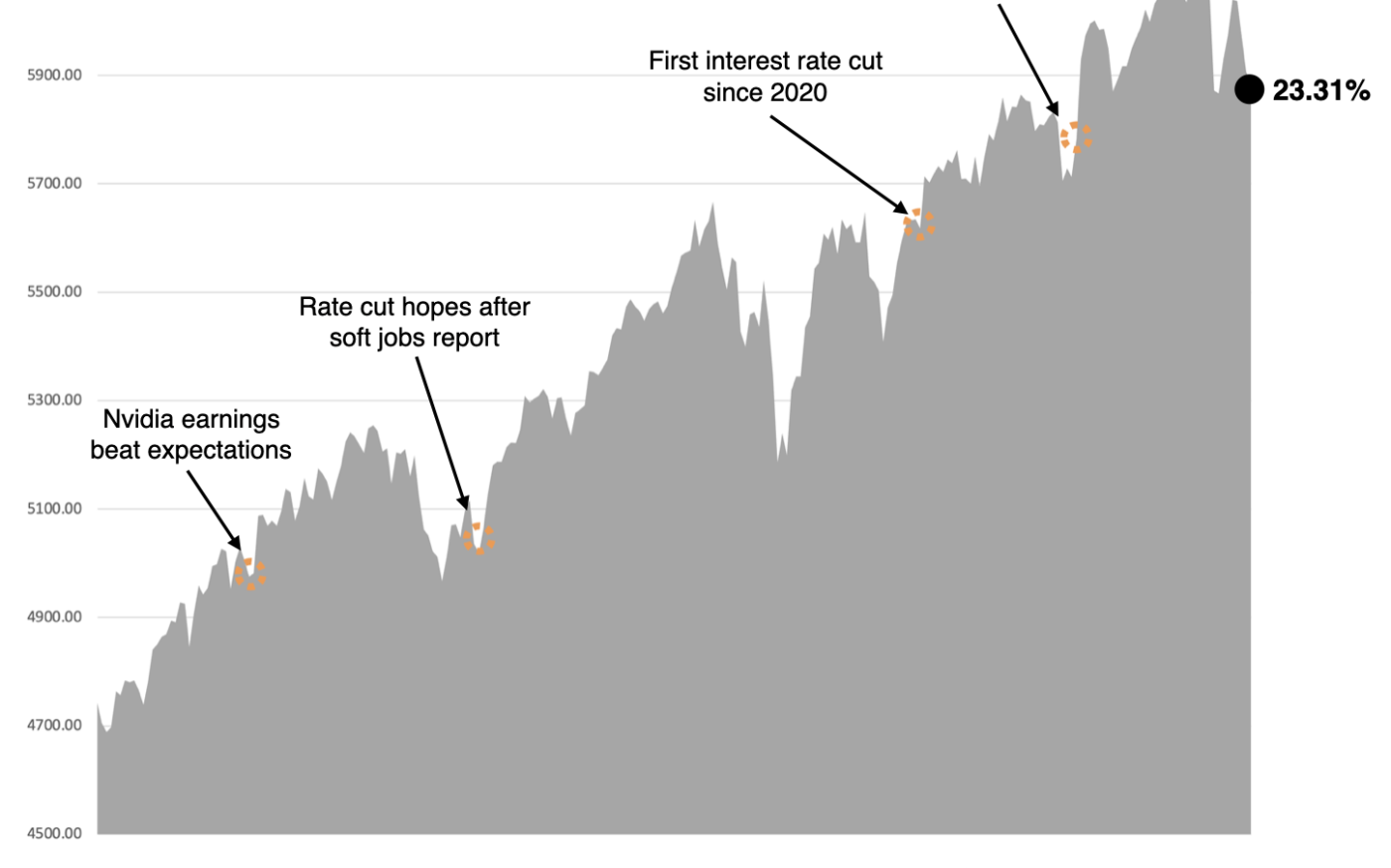

What do you need to know about how markets performed in 2024 (and what could happen next)?

As we step into 2025, I thought it would be beneficial to take a moment and reflect on what an extraordinary year 2024 was for investors.

What money topics are the most taboo to talk about? Earnings, debt, inheritance, or net worth? For most of us, many financial topics are simply off-limits. 1 That means that many...